The Best Guide To Paul B Insurance Insurance Agent For Medicare Huntington

Table of ContentsRumored Buzz on Paul B Insurance Medicare Advantage Agent HuntingtonMore About Paul B Insurance Local Medicare Agent HuntingtonIndicators on Paul B Insurance Medicare Agent Huntington You Need To KnowA Biased View of Paul B Insurance Medicare Insurance Program HuntingtonA Biased View of Paul B Insurance Medicare Agency Huntington

Costs Component An as well as Part B insurance coverage requires repayment of regular monthly premiums. Individuals and married pairs with a revenue over a specific limit should pay a greater premium for Component B as well as an extra quantity for Part D protection in enhancement to their Component D plan premium. This added quantity is called income-related monthly modification amount.If an individual did not register in premium Component A when first qualified, they may have to pay a greater month-to-month costs if they determine to sign up later on. The month-to-month premium for Part A might raise up to 10%.

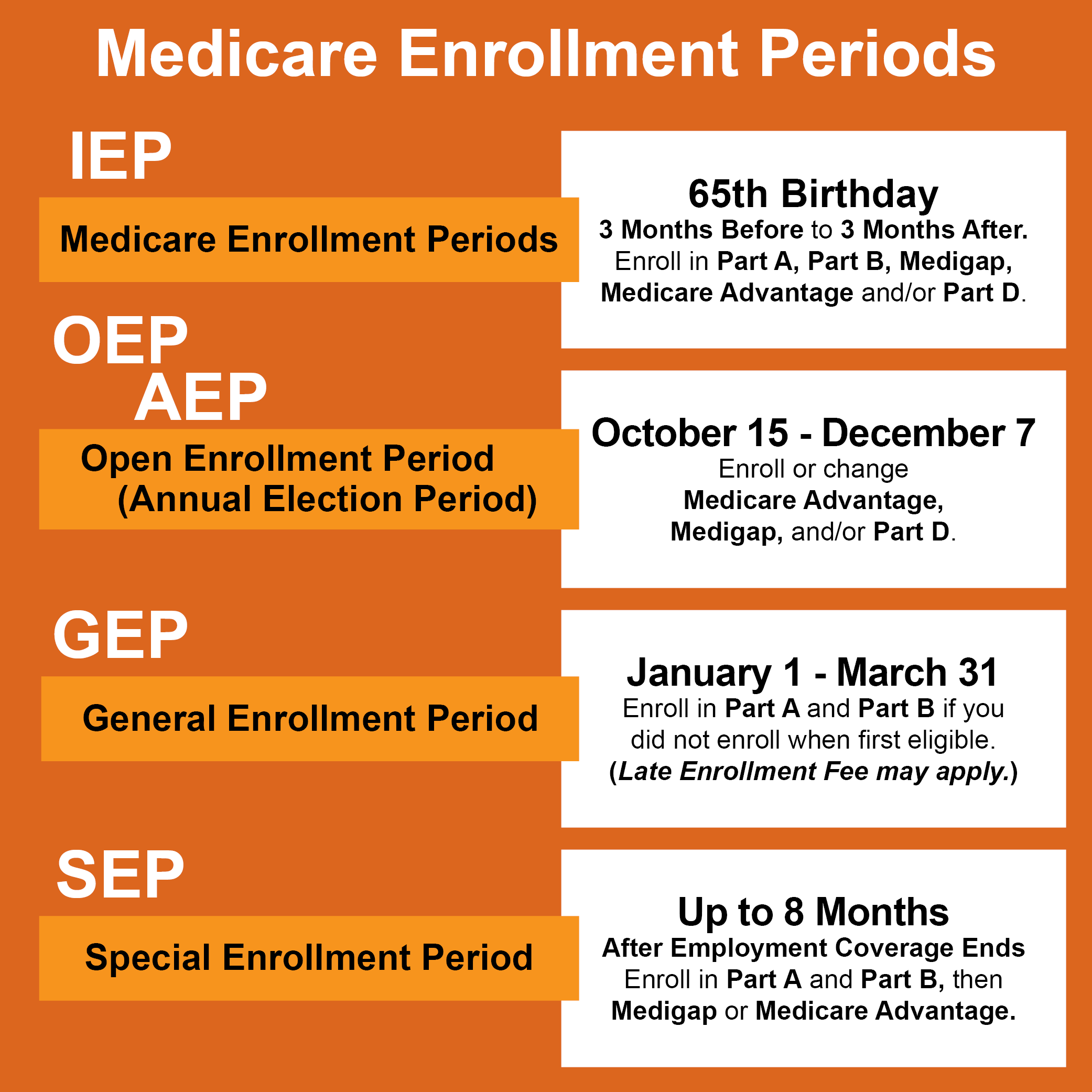

For individuals enlisting utilizing the SEP for the Operating Aged as well as Working Handicapped, the premium Part A LEP is computed by including the months that have expired between the close of the person's IEP as well as completion of the month in which the specific enrolls. For enrollments after your IEP has finished, months where you had group health insurance protection are excluded from the LEP estimation.

If a person did not enroll in Component B when first eligible, the person might have to pay a late enrollment penalty for as long as the person has Medicare - paul b insurance Medicare Supplement Agent huntington. The individual's monthly costs for Component B may increase 10% for each and every full 12-month duration that the individual could have had Part B however did not authorize up for it.

Unknown Facts About Paul B Insurance Medicare Advantage Agent Huntington

For registrations after your IEP has finished, months where you had team health insurance insurance coverage are excluded from the LEP calculation. For people enlisting making use of a Remarkable Problems SEP, the International Volunteers SEP, or the SEP for Certain TRICARE Beneficiaries, no LEP will be applied.

A (Lock, A secured padlock) or indicates you have actually safely connected to the. gov website. Share delicate information just on authorities, secure internet sites.

Medicare is separated into four components: Find out exactly how the various components of Medicare collaborate to aid cover your healthcare expenses. To be qualified for Medicare, you have to go to least one: Age 65 or older Under 65 with certain specials needs Under 65 with End-stage renal disease (permanent kidney failing calling for dialysis or a kidney transplant) or ALS (Lou Gehrig's disease) There are a number of methods to sign up in Medicare: If you make an application for Social Safety before transforming 65, you will be signed up automatically in Medicare Part An and also Part B.

To apply face to face or by phone, find as well as call your neighborhood Social Protection office. Many kinds of healthcare service providers approve Medicare. This consists of physicians, health centers, nursing residences, and also at home treatment carriers. Find a lot more pointers and programs to assist you prepare for retired life.

Paul B Insurance Medicare Part D Huntington - Questions

If you do not qualify on your very own or through your spouse's work document yet are an U.S. person or have actually been a legal local for at the very least 5 years, you can get full Medicare benefits at age 65 or older. You just have to buy right into them by: Paying premiums for Component A, the health center insurance coverage.

The longer you work, the more work credit scores you will make. Work credit reports are gained based aetna health insurance plans on your income; the quantity of income it takes to earn a debt changes every year. In 202 3 you gain one job credit scores for each $1,640 in profits, as much as a maximum of 4 credit ratings each year.

If you have 30 to 39 credit scores, you pay less $278 a month in 202 3. If you continue working until you gain 40 credit scores, you will certainly no much longer pay these premiums. Paying the exact same monthly costs for Part B, which covers doctor check outs as well as various other outpatient services, as various other enrollees pay.

90 for individuals with a yearly earnings of $97,000 or much less or those filing a joint income tax return with $194,000 in income or less. Rates are greater for individuals with greater revenues. Paying the same monthly premium travel insurance online for Part D prescription medicine coverage as others signed up in the drug strategy you choose.

Our Paul B Insurance Medicare Agent Huntington PDFs

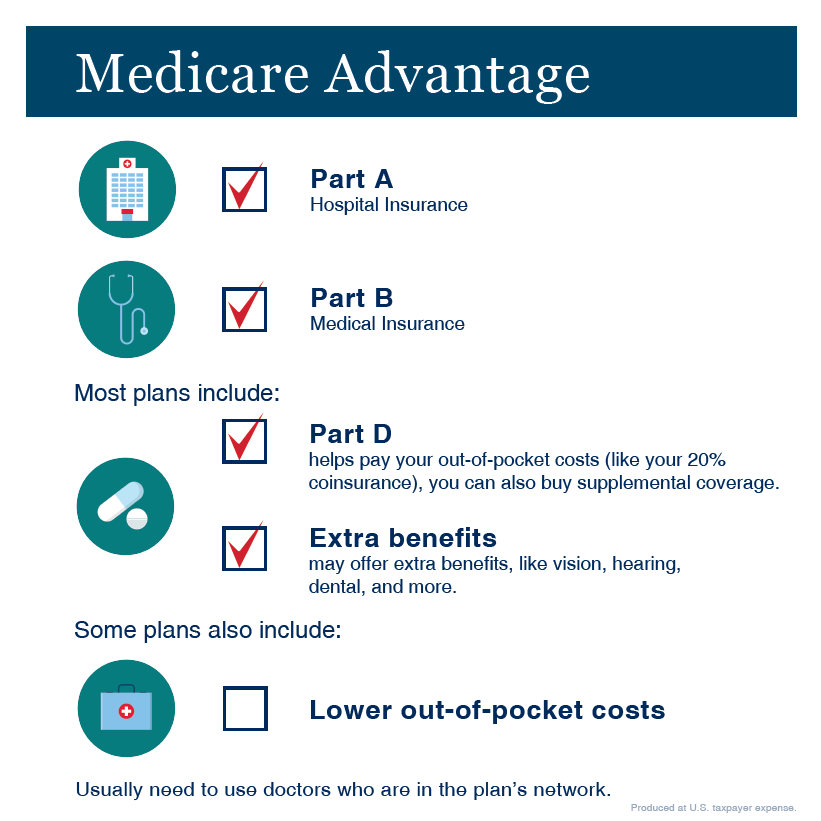

If you buy Component A, you likewise have to sign up in Part B. You can get Part D if you're enrolled in either A or B. You can not sign up in a Medicare Advantage plan, which is a private insurance coverage choice to Original Medicare, or acquire a Medigap supplementary insurance policy unless you're enlisted in both An and also B.

Generally, you're very first eligible to enroll in Component An and Part B beginning 3 months prior to you turn 65 as well as finishing 3 months after the month you turn 65. Because the business has much less than 20 employees, your job-based coverage could not pay for wellness services if you don't have both Part An as well as Part B.

Your protection will certainly begin the month after Social Safety and security (or the Railroad Retired life Board) gets your completed forms. You'll need to load out an extra form showing you had job-based wellness coverage try this website while you or your partner were functioning. If you desire a lot more insurance coverage, you have a minimal time to obtain it.

Moving your health coverage to Medicare can feel overwhelming as well as confusing but we can aid make it simpler. The very first step in choosing the ideal coverage is recognizing the 4 components of Medicare. Listed below, discover the essentials of just how each part works and what it covers, so you'll understand what you require to do at every step of the Medicare process.

(Individuals with particular disabilities or wellness conditions may be eligible before they turn 65.) It's created to protect the health as well as health of those that use it. The 4 parts of Medicare With Medicare, it is very important to recognize Components A, B, C, and D each component covers certain services, from treatment to prescription medications.