Comprehending the Importance of Insurance Coverage: Securing Your Future

In today's uncertain world, comprehending the value of insurance is important for safeguarding your monetary future. Insurance not just offers as a buffer versus unforeseen events yet additionally equips people to seek their ambitions with confidence.

What Is Insurance coverage?

Insurance is a contractual setup that provides financial protection versus possible future losses or obligations. Basically, it functions as a protect for people and businesses, allowing them to move the danger of unforeseen occasions to an insurer. This system runs on the concept of risk pooling, wherein multiple customers add costs to a collective fund. When a protected loss happens, the insurance firm disburses funds to the affected celebration, consequently reducing their economic worry.

The essential parts of insurance coverage consist of the insurance holder, the insurance company, the premium, and the protection terms. The insurance policy holder is the individual or entity purchasing the insurance policy, while the insurance provider is the business giving the coverage.

Kinds of Insurance Coverage Coverage

A large variety of insurance policy protection alternatives exists to attend to the varied needs of companies and people. Each kind of insurance coverage offers a special function, providing protection against details risks.

Medical insurance is necessary for covering clinical expenditures and ensuring access to health care solutions. Car insurance policy shields automobile owners from monetary losses as a result of crashes, theft, or damages to their cars and trucks. Property owners insurance coverage safeguards homeowner against threats such as fire, theft, and natural calamities.

For businesses, obligation insurance policy is important, as it protects against claims arising from injuries or problems created by company procedures (insurance). Home insurance coverage covers the physical properties of a service, while employees' compensation insurance coverage provides benefits to employees injured at work

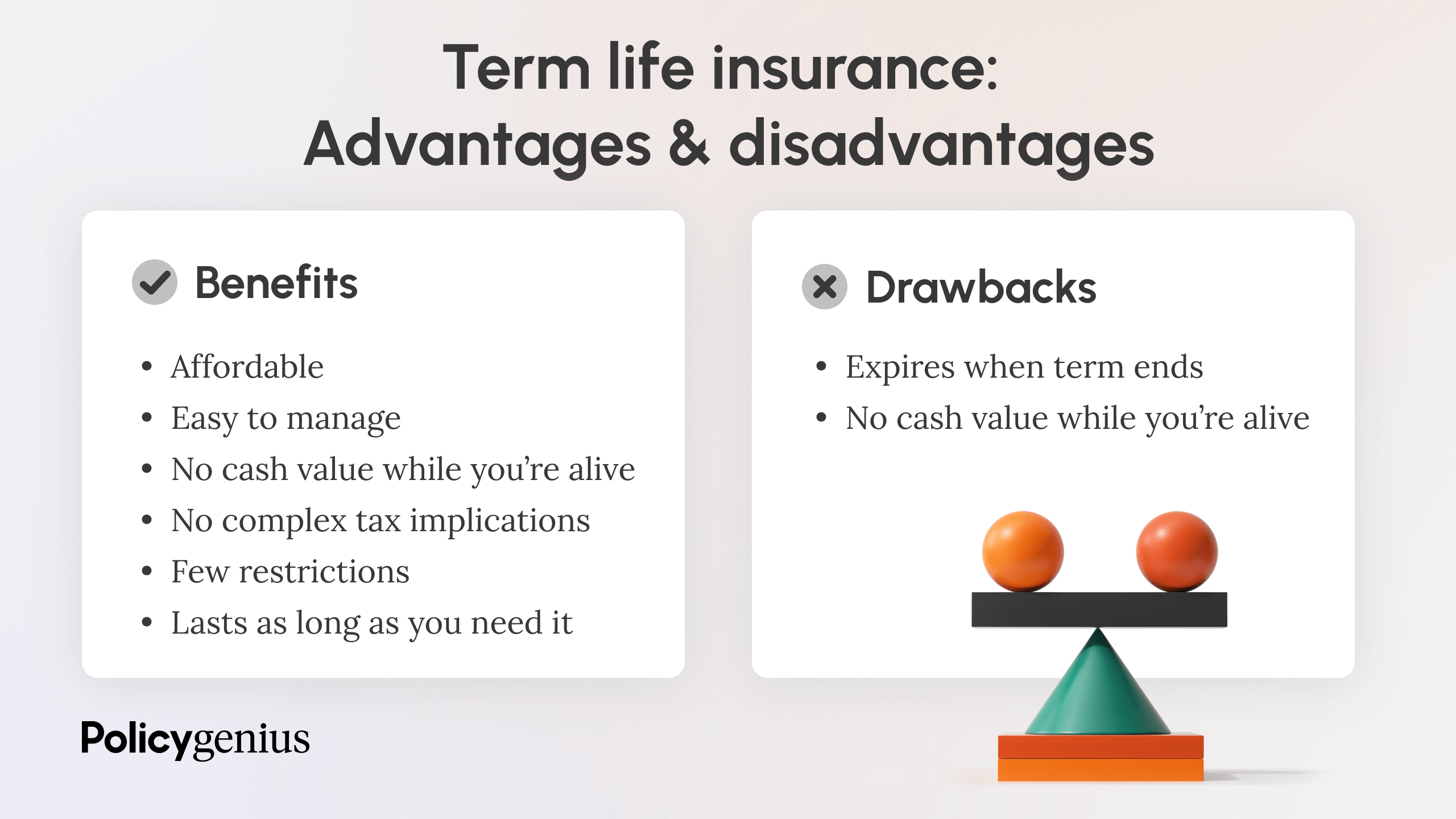

Life insurance policy provides monetary safety and security to beneficiaries in the occasion of the insured's death. In addition, special needs insurance policy supplies income substitute if the policyholder comes to be unable to function as a result of disease or injury.

Understanding the numerous types of insurance coverage is essential for making informed choices concerning personal and service protection. By recognizing certain demands, people and companies can choose the proper plans to alleviate threats successfully.

Advantages of Having Insurance

Having insurance gives individuals and companies with an important safeguard that aids reduce financial dangers related to unanticipated occasions. One of the primary benefits of insurance policy is monetary security. By transferring the risk of prospective losses to an insurance policy service provider, insurance holders can guard their assets, whether it be a business, home, or lorry financial investment.

Additionally, insurance promotes assurance. Knowing that you are shielded against significant financial problems enables organizations and individuals to concentrate on everyday operations without the consistent fear of unforeseen expenditures. This assurance can boost overall health and productivity.

Insurance policy also promotes security. In case of a loss, such as an all-natural calamity or accident, insurance policy protection ensures that individuals and companies can recuperate much more swiftly, lessening interruptions to their lives or operations. Many insurance policy policies use added benefits, such as accessibility to resources and skilled recommendations throughout crises.

Last but not least, having insurance policy can assist in conformity with lawful demands. Specific sorts of insurance, such as responsibility protection, are mandated by law, making certain that businesses and individuals operate within the lawful structure while protecting themselves versus possible insurance claims.

Just How to Choose the Right Plan

Selecting the suitable insurance coverage calls for mindful consideration of private requirements and scenarios. Begin by analyzing your specific needs, such as your economic situation, way of living, and the possessions you desire to secure. Determine the sorts of protection you need, whether it's health, vehicle, home, or life insurance coverage, and establish just how much insurance coverage is required to effectively guard your rate of interests.

Following, research different insurance policy suppliers and their plans. Pay attention to the information of each plan, consisting of premiums, deductibles, coverage restrictions, and exemptions.

Typical False Impressions About Insurance

Many misunderstandings concerning insurance can lead to complication and inadequate decision-making amongst consumers. One widespread myth is that insurance policy is an unneeded cost, often viewed as losing money on premiums without substantial benefits. Actually, insurance works as a safety web, guarding people and households against significant economic loss.

One more typical misunderstanding is the idea that all insurance coverage coincide. Policies can differ extensively in coverage, exemptions, and expenses. It is vital for consumers to thoroughly research study and understand their options to ensure they select a plan that meets their details demands.

Many individuals also think that they are immediately covered for all occurrences under their plan. However, many plans have particular exemptions and restrictions, which can lead to unforeseen out-of-pocket costs. This highlights the importance of thoroughly assessing the conditions of any kind of insurance plan.

Last but not least, some people believe that filing a claim Look At This will constantly lead to greater costs. While this can be true sometimes, several insurance firms take into consideration the overall threat profile of an insurance policy holder. Recognizing these mistaken beliefs is vital for making informed choices regarding insurance and making certain proper protection.

Final Thought

In recap, insurance coverage serves as an essential mechanism for financial protection versus unforeseen events, contributing to general security and tranquility of mind. Attending to usual false impressions further boosts awareness of insurance coverage's function in guarding properties and making certain a safe and secure future for households and people alike.

The policyholder is the individual or entity purchasing the insurance coverage, while the insurance company is the business offering the protection. In the occasion of a loss, such as an all-natural calamity or accident, insurance policy protection ensures that businesses and individuals can recuperate much more quickly, reducing interruptions to their lives or operations.Choosing the proper insurance coverage policy needs mindful factor to consider of specific requirements and situations. Determine the kinds of insurance coverage you need, whether it's health and wellness, automobile, home, or life insurance policy, and figure out just how much insurance coverage is necessary to adequately guard your interests.

Recognizing these mistaken beliefs is important for making informed decisions regarding insurance coverage and making certain proper insurance coverage.